If you’re trying to choose between CA, CFA, and CS (considering the hype they’ve been creating these days), your search ends here. Finding the right course can be a daunting task, especially when there are so many choices at hand. But when it comes to planning your career, don’t just follow the herd or blindly accept opinions (even from well-meaning family members).

Make an informed decision based on your own research, or talk to people who have already been through the course you’re considering.

If you thought CA was “just numbers,” allow us to explain.

Common Ground

One thing that’s common to these 3 courses is that they all deal with finance.

Chartered Accountancy is a course in which you study subjects like accounting, business communication, general economics, and financial management. Working as a Chartered Accountant, you’d be in charge of audits, taxation, company law, and financial accounting.

If you got the Company Secretary route, you’ll learn business communication, economics and business environment, accounting, business laws, and information systems. Your primary role at such a job would be of that of a mediator between the company and its board of directors.

A Chartered Financial Analyst course will help you gain insight into areas like financial reporting and analysis, corporate finance, equity investments, wealth planning, and portfolio management. As a Chartered Financial Analyst, you’d work as a security analyst and handle portfolio management and business reports for your company.

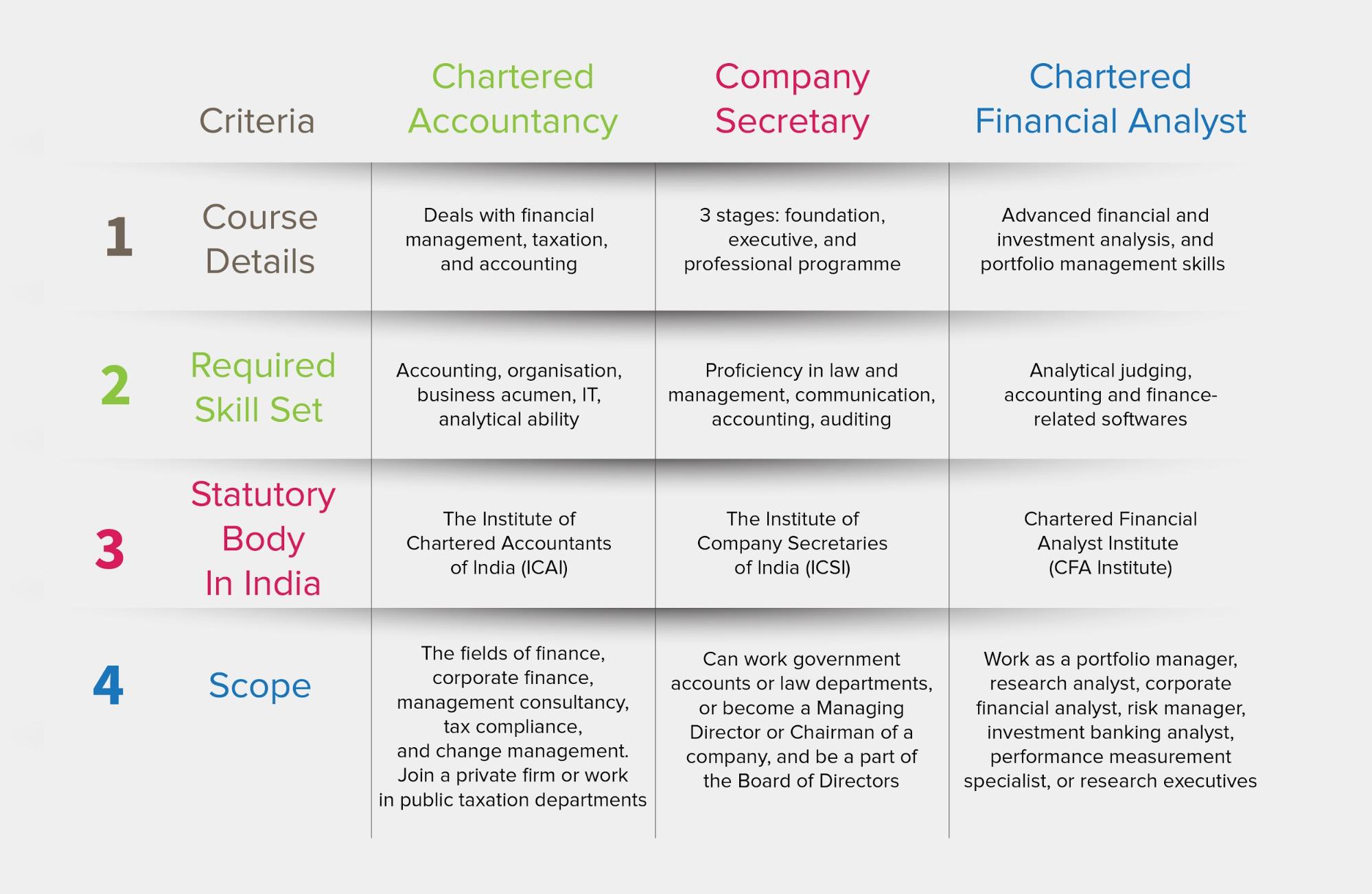

Let’s take a look at some of the core features of these courses:

You’ve Made Your Choice. Now What?

Chartered Accountancy

In India, You can apply for CPC (Common Proficiency Course) right after 10th grade, or a CPT (Common Proficiency Test) course after your 10+2. There are many CPT classes that help you nail the examination through intensive lessons.

After your IPCC (Integrated Professional Competence Course), you will have do a 3-year apprenticeship under a CA. Finally, you’ll write an exam before you actually acquire the title of CA.

Company Secretary

For the foundation course, you’ll need to have completed the 10+2 examination from a board or university of India. Once you’ve passed the foundation course and are above 17 years of age, you can apply for the Executive Programme.

If you’ve passed the final exam of the ICWAI, the ICAI, or another accountancy institution in India or abroad (recognized by the council of the institute you’re applying to, of course), you can directly enroll into the Executive Programme.

After passing this course, you’ll be eligible for the Professional Programme, after which you’ll get your certification.

Chartered Financial Analyst

To be eligible for this course, you need to have a 4-years bachelor’s degree and 4 years of work experience. Having a passport is mandatory to enrol into this programme and for the exams. If you don’t have the required work experience, you’ll get your certifications when you complete it.

The course generally takes 2-5 years to complete. The best part of this course is that there’s no limit to the number of times you can attempt it!

Choosing between CA, CFA, and CS isn’t a hard decision if you go through these factors first. All that’s left to do is make your decision based on the career path you want to follow.

All the best!