Money doesn’t seem to be bound by the laws of reality. There’s no other way to explain the whole ‘here one second, gone the next’ thing that it has going.

Well, actually, there probably is—improper money management (a.k.a, being stupid with your cash). You’ve got to learn how to save money.

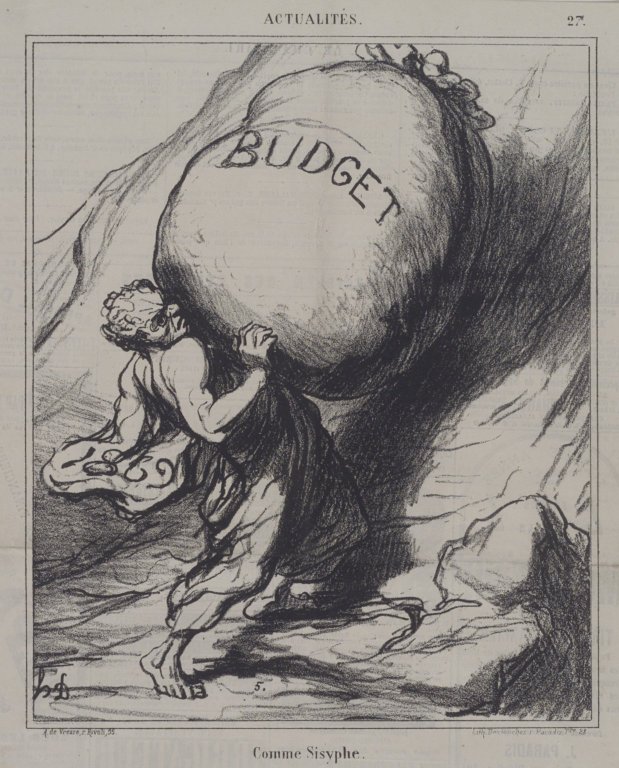

For people who need to live on a budget, which includes most of us, it’s important to actually try to make it through the month comfortably. And honestly, it’s not as hard as it sounds.

- Track Expenses & Cull Everything Unnecessary

This is the all-important first step. If you don’t do this, you might as well not do the rest. ‘Winging it’ is not something you can afford to do when it comes to money, literally.

Take stock of what your basic expenses are. These include rent, electricity, food, travel, and of course, Wi-Fi.

Then track your other expenses throughout the month. This tells you exactly where you’re spending too much. After this, it’s simply a matter of restricting the unessential.

A solid budget will make a huge difference to your life.

When it comes to culling the unnecessary, this includes things like eating out when you could be packing a cheaper (not to mention, healthier) lunch from home. And weekend binges tend to be much cheaper when they happen in the comfort of someone’s home.

- Ditch Plastic

Credit and debit cards might seem like god’s gift to mankind sometimes, but convenience aside, they’re usually bad for your financial stability.

When you swipe your card at a commercial outlet, you don’t usually realise how much you’re spending. You’ll know the amount, but you won’t feel the amount.

A simple solution to this is to only spend cash. Withdraw money from an ATM for the whole day, or even for a couple of days at a stretch, and only pay in cash for everything you buy. This will definitely help you be more mindful of your money.

- Work Freelance

Now that you’re saving as much money as possible and living within your means, you’re free to explore ways to expand your ‘means’. Supplementing your income, again, isn’t as hard as it sounds. Here’s how to make money on the side:

If you’re a programmer, look for freelance coding projects. If you’re a writer, look for part time blog writing work. Because of the Internet, this is easier than ever! You might even be able to find part time work on sites like Quikr.

- Turn Your Hobby Into A Source Of Income

Is there something you love to do in your spare time? Monetise it.

Whether it’s making vaguely disturbing stuffed animals or sketching people using charcoal, there’s probably someone out there who wants to buy what you’re selling.

There’s no such thing as free money, but there’s a demand for pretty much anything you can think of. All you have to do is find someone who’ll pay you for what you want to do.

- Treat Yourself Occasionally

This is probably the second-most important tip in this article (after Track Expenses & Cull Everything Unnecessary).

Why? Because allowing yourself a carefully controlled outlet for those spending urges ensures that you’ll probably be less inclined to go on massive benders and burn through your money.

Seriously, try this out.

Instead of living like a monk, go out to a nice place for dinner once a month, and you’re less likely to be tempted to splurge uncontrollably when you pass a fast food joint.

Dealing with your money smartly frees you up to focus on the stuff that’s actually important.